Top 6 Scary Money Statistics – No. 5 Is Shocking

Top 6 Scary Money Statistics

– No. 5 Is Shocking

Since fildane.com is dedicated to finding great ways of improving personal finances for my readers, I always make a lot of researches before publishing a blog so I get to see the whole picture.

However, my researches usually lead me to some scary money statistics whenever it comes to financial topics.

Welcome to today’s topic “Top 6 Scary Money Statistics – No. 5 Is Shocking”.

I hope this post will help to rethink and gives you the inspiration to improve your personal finances.

Here we go…

Fact #1:

Almost 80% of People

Are Living

Paycheck To Paycheck

According to the American statistics, there are almost 80% of people (78% to be exact) in the US who lives Paycheck to Paycheck.

This is not because of a job crisis. In fact, the unemployment rate is only 3.8%. However, although people have jobs, they’re ending up living this lifestyle because of the crisis of low wages.

Sadly, according to another survey, most of these households with a paycheck to paycheck lifestyle have less than $800 to cover them until the next paycheck.

If you are one of the people who live this lifestyle, I strongly suggest trying to find ways to get out of this bad situation immediately.

Having money set aside and a buffer or emergency fund can greatly help in times when you need it.

Fact #2:

$44,500/year

And Lower If You’re A Woman

Or Has No Education.

A typical American worker now earns around $44,500 a year. This is not much more than what a typical worker earned in 40 years ago, adjusted for inflation.

The BLS (Bureau of Labor Statistics) reports that for the fourth quarter of 2017, men earned a median average of $49,192 while women earned only $39,988 or 81.3 percent of what males earned.

However, workers age 25 and over without a high school degree had average annual earnings of $27,612 at the end of 2017 compared with $37,128 for high school graduates without a college degree.

Ultimately, college graduates with at least a bachelor’s degree earned $66,456 annually. Here you can see that education pays off.

And take note, this is for 40 hours a week job. And these figures are the income before taxes.

Fact #3:

$1.5 Trillion

Total Student Loan Debt

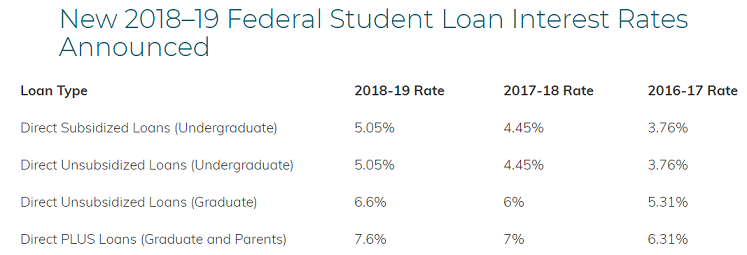

According to the article from forbes.com, there are more than 44 million borrowers who collectively owe $1.5 trillion in student loan debt in the U.S. alone.

Taking into account of the Class of 2016, the average student has $37,172 in student loan debt.

Not surprisingly, the statistics for 2018 show how serious the student loan debt crisis has become – for borrowers across all demographics and age groups.

As you can see you the interest rates are getting higher every year. This creates stress on the national level.

So, if you have a student loan, you may want to refinance it or find ways to paying it immediately.

Fact #4:

$0-$5,000

Retirement Savings

(54%)

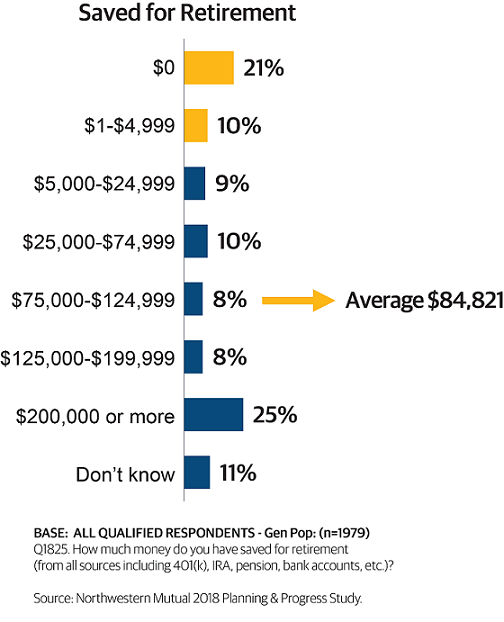

According to experts’ recommendation, you need at least $1 million to supplement Social Security, pensions and any other sources of funding you may have when you retire.

Related Post: Is $1 Million Enough To Retire?

However, Americans have shockingly under saved for their retirement.

The average amount of Americans have socked away for the future is slightly higher, but it’s still just $84,821.

Northwestern Mutual’s 2018 Planning & Progress Study, which surveyed 2,003 adults, showed that only 21% of Americans have NO retirement savings at all for their golden years. And 33% of Americans have only $5,000 in retirement savings.

To sum it up, there are at least 54% of Americans who will be forced to stay working in their old age because they’ll be able to afford retirement.

Fact # 5:

55 Million Americans

Have No Emergency Fund

According to Bankrate.com survey of 1,000 adults conducted in June 2018, there are roughly 55 million people (23%) said they had nothing saved in an emergency fund.

And there are only 29% of Americans who can cover a ‘six-months’ worth of expenses. Sadly, there are only 39% of Americans who can cover a $1000 emergency.

In another survey, there are 69% of Americans who don’t even have $1,000 savings according to a 2016 GoBankingRates survey.

Ultimately, the experts’ recommendation for an emergency fund is an equivalent of at least 8 months of your expenses and any less will be a risk. You need as much money in the bank that makes you feel secure.

If you currently don’t have enough emergency fund, you may consider to reconstruct your budget and dedicate more money to savings and investing. This way, you start building your emergency fund and your future’s stability.

Fact #6:

World’s Broken Workplace

Everybody wants financial freedom. Some people love their jobs. Unfortunately, there are only a few of them who do.

According to the research which was released by Gallup.com, there are only 15% engaged full-time employees worldwide.

This means that around 85% of full-time employees around the world hate their jobs.

Surprisingly, the same research shows that there are around 94% of all Japanese employees that are not engaged with their jobs. Japan is then the World’s Broken Workplace.

Surprisingly, the same research shows that there are around 94% of all Japanese employees that are not engaged with their jobs. Japan is then the World’s Broken Workplace.

Are you one of the 85% of people who wants to quit their job?

Do you want to take control of your life and become free from our modern slavery called 9-5 day job?

Then you know, you’re not alone.

Conclusion:

There are many people around the world, not only Americans, who are struggling with their personal finances. Unfortunately, managing personal finances is not part of the curriculum in the school.

Personal finances is a very crucial part in one’s life and it is very important to manage it well. As the saying goes “You need to manage your money before your money starts to manage you”.

Personal finances vary according to ages and these are my recommendations in improving it.

For Children – Managing Money For Children

For the 20s – The Power Of Investing Early – 4 Tip for 40s

For the 30s – Best Ways To Manage Your Money At Your 30s – 8 Tips

For the 40s – Top Financial Planning Tips For 40s

For the 50s – Top Financial Tips – Catching Up For 50s

For the 60s – Top 5 Financial Tips For 60s (Pre-retirees Must Know)

Unfortunately, if you reached your retirement age without having your personal finances ready for it, then you will have to work until you die.

Solutions

Well, having financial constraints and crisis require a higher source of income to be solved. If you want to sustain your lifestyle or to have a better lifestyle, then you need to consider getting a job with a higher salary.

Alternatively, you can start your own business in your free time.

The good news is, you can easily do that if you have access to a computer and the internet.

However, be careful of what you’re diving in when it comes to online business. I have reviewed a lot of money-making-programs around and almost all those programs are craps and garbage if they are not scams.

Check my number 1 recommendation in building an online business, where you can get started for FREE and the premium membership is only optional. This is also where I started and you can get access and start your journey here.

Today, I love working for my own business from home. Affiliate marketing is a type of business that has made many people a huge fortune while others are just earning around $10,000/month and this is what I’m doing and I love it.

See, how I earned up to $1,174.09 per day doing product reviews here.

There are many reasons why you should use this concept to earn a full-time income from home. And these were my reasons when I started with this business.

- I can earn money with any product online

- The simplest and easiest concept for online business

- Sure success as long as you keep going

- Unlimited earning potential

- No face-to-face or direct selling

- No face-to-face rejection

- No networking

- No recruitment

- No inventory

- No administrative work

- Very low investment

- I can work entire just with my laptop and internet.

- I am my own boss

- Scam protected

- I can earn Passive Income online!

So, if you hate product demonstration or presentation, public speaking and certainly not a fan of recruiting your families and friends just to earn, then this is the best business for you.

However, I know this business is not for everybody and there are some other opportunities rather than affiliate marketing. So, I have created a list of the proven ways to earn money online for you.

Start your affiliate marketing business now.

Earn while learn and build your passive income online.

I’m looking forward to seeing you and guiding you in this awesome community. See you on the inside.

This is the end of my topic today “Top 6 Scary Money Statistics – No. 5 Is Shocking”. I hope this post will help you to improve your personal finances and be better than the “average” person.

If you have any thought or question, please don’t hesitate to leave a comment below. Good luck with your journey to financial freedom online. God bless!

Che’s Top Recommended Programs

- Wealthy Affiliate University – To learn how making money online really works. Open your FREE account here (No credit card info required)

- 3-Steps In Making Money with Bitcoins And Other Cryptocurrencies – Instant Money If You Have A little Money To Invest.

- Rich Dad Summit – To learn how to leverage mortgage and retire early- 2-days training for only $1.

- If you are completely broke, try these simple gigs online to earn and save money.

- 15 Proven Ways To Earn Extra Money From Home Online

- 15 Proven Ways To Make Money On Fiverr.com

- 130 Websites That Will Pay You $50- $3,000 Per Post (Plus 1,000 Writing Jobs)