Investment Property Tips: Best investment?

Investment Property Tips.

One of my major investments since 2002 is investment properties in real estate. Investing in real estate is one of the best investment you will definitely love if you can do it right.

In fact, it is the number 1 among other types of investment when it comes to long-term investment. Honestly, if you know how to do it right, you will be able to achieve financial freedom in a relatively short period of time.

Investment Property in this article refers to the property acquired with the purpose of generating passive income.

13 Types of Investment Properties

1. Single Investment Property: a single family house or condominium bought for the purpose of renting out to acquire monthly cash flow.

2. Multi-Investment Property (Small): a property which has a 2-4 unit house or apartment.

3. Multi-Investment Property (Large): a property which has 5 or more residential units, like an apartment complex.

4. Holiday/Vacation Investment Property: refers to holiday houses to be rented out in a long-term or short-term.

5. Commercial Investment Property: a property with a commercial use bought to be rented out.

6. Mixed Purpose Investment Property: a property with a combined residential unit/s and commercial unit/s.

7. Office Investment Property: a property composes of 1 or more office bought for the purpose of rental business.

8. Retail Business Investment Property: a property bought for the purpose of renting out for a retail business such as mini market, kiosk, drug store or pizza parlor.

9. Industrial Investment Property: a property bought to be rented out such as a warehouse, manufacturing business etc.

10. Land as an Investment Property: a piece of empty land for the purpose of ‘buy and hold’ and sell it after a number of years.

11. Farm as an Investment Property: A huge piece of land that has a farming purpose like corn, rice etc. bought for the purpose of renting/leasing out to farmers.

12. Hotel, Motels, and Hostels: an investment property that has daily rental and operation.

13. Subdivision Investment Property: is a huge piece of land, bought for the purpose of developing and building houses to be sold in the market individually.

13. Subdivision Investment Property: is a huge piece of land, bought for the purpose of developing and building houses to be sold in the market individually.

People who normally investment in real estate:

1. Entrepreneurs who have success with their primary business ventures and want to diversify their investments.

2. Any individual who has very good personal finances and wants to earn more money passively.

Why is Investing in Real Estate the Best Investment?

1. The advantage of Gaining More Leverage.

Having a good personal finances open more doorways to success because banks are basing their evaluation based on your financial situation. That means you can you bank’s money to any type of business you may want to engage with. So, if you buy an investment property, you just need to pay the initial downpayment as your main investment and the rest will be your bank’s money. This is an incredible investment vehicle because you can leverage your capital and increase your overall return on investment (ROI).

2. Tax-free Business Growth.

There are different types of taxation when it comes investment properties whichever state or country you live in. Basically, obtaining mortgage loan will entitle you a huge tax exemption due to interest expenses. And if you are investing properties for the purpose of renting them out, you can declare all the operational expenses aside from interest expenses and thus pay minimal tax or offset as zero. Deferred taxation is one of the best strategies you can consider to take advantage of the system in a long-run.

3. Business Cashflow as Tax-Free.

As a property depreciate and mortgage interest deductions occur over the period of the time (leveraging capital), your cash flow will most likely be tax-free. And that is true. Most of the real estate investors will never pay taxes on their cash flow (deferred taxes) and can wait for capital gains when they sell the property in the future.

4. Tax Write-Offs.

If you have other sources of income other than property investment, like your own personal income, you can declare your tax exemptions/benefits against your other income. And if you have multiple sources of income, you can discuss this matter with your Accountant.

5. Increased in Tax Deduction

Real Estate Investors can convert a lot of their personal expenses to valid operational expenses for the business, like travel expenses and some other miscellaneous expenses. This will, of course, increase your tax deductions and increase your cash flow positively.

6. Rental Real Estate as a Retirement Plan.

Most of the people who lack financial education are normally terrible in planning their retirement life. There are a lot of small business owners who retire with a very small amount of monthly pension benefit when they reach retirement. However, buying an investment property that generates monthly income can secure you a better retirement life.

The majority of successful entrepreneurs diversify their investments – most of them have investment properties, which they acquired from the profits taken from their primary business as part of the retirement plan.

Final Words

In my opinion, investment properties are still the best investments ever since. This is highly recommended for anyone who wants to achieve financial freedom slowly but surely.

Considering the tax benefits, leverage opportunity, value appreciation of the property over time and the monthly cash flow- will provide you a financial stability and protection from inflation.

In a general economy, Inflation occurs year after year. It increases the value of your property and you could increase monthly rental correspondingly. That is why investment in real estate is considered as the hedge against inflation and the safest type of investment of all time.

Remember that in every type of investment, there is a risk tied up with it. So make sure you educate yourself first before diving into it. I am pretty sure you will love this type of investment.

I hope you enjoyed reading this article. If you have any other tips on the investment property, you can write them down on the comment box and I will be grateful to read them from you. Good luck with your journey to financial freedom and God bless.

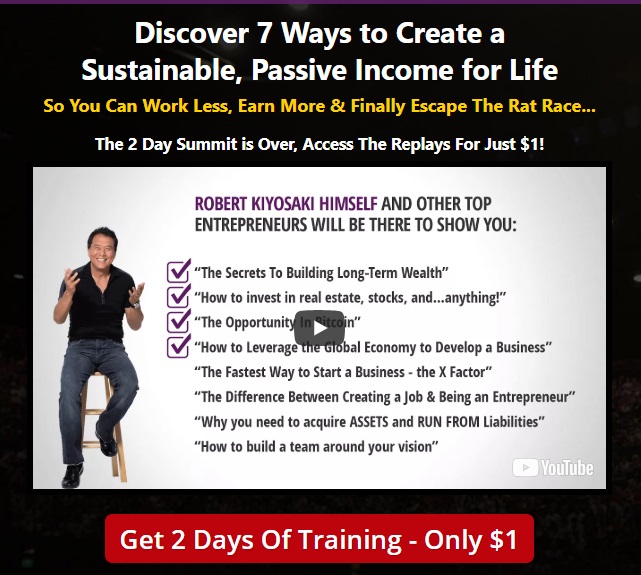

Psst! do you want to attend a 2-day training with one of my favorite mentors? This is your chance for just $1. Yes, that’s right – only $1.

(He is the man behind my success with real estate Investment – Robert Kiyosaki)