If you were approached by a family or a friend to get a life insurance that offers a business opportunity at the same time, that’s probably Primerica.com!

I’m glad you’re doing your research about Primerica.com before anything else. That’s how exactly you can guard yourself and make a better financial decision – be well informed before dive in.

Welcome to today review: “What Is Primerica.com? [A Good Life Insurance Or A Business Scam?]”.

In this review, I’ll provide you every information you need – the company background, products, services, business opportunity, pros and cons, etc.

I’m not associated with Primerica.com so you can assure a honest and unbiased review throughout the post.

Ready to know the truth about Primerica? Let’s get started then.

What Is Primerica.com? [A Good Life Insurance Or A Business Scam?]

Table of Content

Primerica.com Review: Overview

- Company Name: Primerica

- Founder: Arthur L. Williams Jr.

- Year Started: 1977

- Price: $25/month (as sales representative)

- Rating: 50/100

- Recommended: No

What Is Primerica.com?

Primerica.com is the website behind the Primerica, Inc.. Primerica is an american multi-level marketing company that sells insurance and other financial products and services.

The company is founded back in 1977 by Arthur L. Williams Jr. and its headquarters are located in the State Of Georgia.

Primerica, Inc. was previously connected with the Citigroup as its parent company.

Over the years, Primerica has delivered success results. In fact, it was listed by Forbes as one of “Americas 50 Most Trusthworthy Financial Companies” in 2015 but was not included in the 2017 list.

Primerica’s Latest Annual Revenues:

Revenue 2015: $1,417 million

Revenue 2016: $1,537 million

Revenue 2017: $1,715 million

Revenue 2018: $1,937 million

Primerica Reviews: Legal Problems

Behind Primerica’s success, it is not that surprising that this company has faced some legal issues previously, probably because of it’s MLM business model.

2012 – Primerica had multiple lawsuits alleging that the company’s representatives sought to profit by earning commissions after convincing Florida firefighters, teachers and other public workers to divest from safe government-secured retirement investments to inappropriate high-risk retirement products offered by Primerica itself.

2014 – Paid $15.4 million to settle allegations involving the above issues – a total of 238 cases.

2015 – Primerica was banned by the district’s school board from Longview ISD campuses due to a meeting held in a campus that generated numerous complaints and violated the school district’s employee policy manual.

2017 – Registered investment adviser Mike Lundy, a representative of Primerica and manager of its Rapid City, SD office, was sentenced to 5 years in federal prison after pocketing his clients’ money amounting to $4.2 million.

Primerica Reviews: Products & Services

Primerica.com offers different kinds of financial products and services.

Insurance:

- Term Life Insurance (Most Popular)

- Long-term care insurance

- Auto insurance

- Home insurance

Investment:

- Mutual funds

- Annuities

- Segregated funds

- Managed accounts

Others:

- Pre-paid legal services

- Credit monitoring

- Debt management plans

I must admit the company offers a great opportunity to manage personal finances and I understand why it has been very popular and profitable for many years.

If you want to secure your finances (and your family), insurance and investments should definitely on your priority list. However, whether you choose Primerica as your insurer and investment company is a matter of your personal choice.

Their prices are not disclosed on Primerica.com so it’s difficult to compare to it with other insurance and investment companies. See the Consumer complaints below.

BUT! if you are joining the Primerica for business purposes – then you should think twice as MLM is a broken business model and the success rate is very low. I’ll get back to that later.

A Profitable Home Business Is Simple

If you have the right training, supportive community & mentor, making money online is easy. Click below and get all the three:

How To Earn Money With Primerica?

Primerica’s business model is based on multi-level marketing. It offers up to 11 level or eleven-tiered commission structure for sales representatives.

In 2010, it’s reported that Primerica’s sales representatives pay $25 monthly fee to do the business and earn money.

How Do You Earn Commission as a sales representative?

- You will earn 25% commission on every life insurance policy you sell.

- You will also generate 70% of commission for your upline from the same sale.

- When you are starting out in Primerica, your upline will earn 2.8 times more commission than you on any sales you complete.

- Your upline will try and use this big commission difference in pay to motivate you.

How Much Do Sales Representatives Earn With Primerica?

In 2010, Primerica has 100,000 representatives selling the company’s financial products, with individual earnings averaging $5,156 per year.

In 2014, Primerica reported that there were only 3,700 out of 190,000 licensed sales force who boosted (worked hard) and each of the sales team earned an average of only $6,030 that year.

Computation of Success Rate:

Unfortunately, there is no enough data to calculate the real (or closed to near) success rate of Primerica for those who work for them in the sales force.

However, if the above information we can say that the success is terribly low as an average earning of $6,030 per year will not be a success on ideal criteria for business. I would say atleast $50,000 per year or $5,000 per month before tax as a minimum if you are living for example in the US or Europe.

Boosted Sales Force is only at the rate of (3700/190000) = 1.94% and the earn $500 per month.

Primerica Reviews: Sales Strategy

A lot of insurance experts criticize Primera due to its MLM structure and prices transparency on their website. Primerica.com doesn’t offer life insurance quotes which making it hard to compare its prices with other qualified insurance companies.

However, due to its network marketing structure, you may find friends and family members buying the products and the sales representative’s could create extra pressure to buy insurance and other financial products and services offered by Primerica.

And needless to say, this will also encourage them to become a part-time agents later on, which is in the contrary of what seems to be normal in the financial market.

Most of the insurance and investment companies hire their own Sales Representatives, Insurance Agents, Broker Or Investment Experts on Full-time basis. These people are normally being hired either after long years of training, experience, formal education degree and licensed holder.

Yes, they get commission (1 level commission) aside from their basic salaries. Nope! they don’t pay monthly fee as in the case of Primerica’s sales representatives.

Get started with the best training program in online business – this is where I learned to earn up to $1,174.09 a day. Try It FREE.

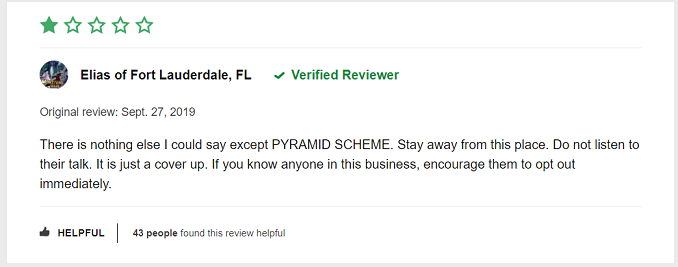

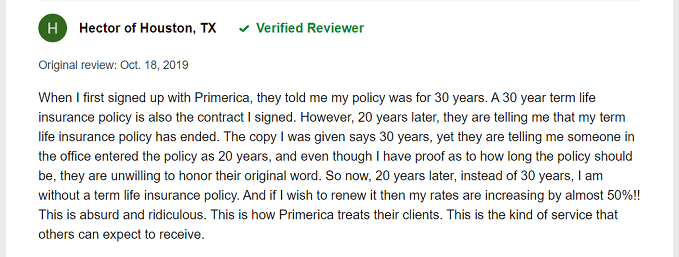

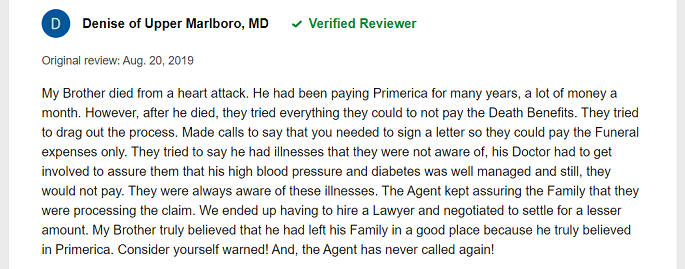

Primerica Reviews: Consumers’ Complaints

In every business, there’s always something good and something bad that the customers, users or consumers will have to say.

Whether you want to become a client or sales representative, you definitely would want to know what the market or the people who tried the product have to say.

Satisfied consumers mean good products/services and also the opposite.

Here are some complaints against Primerica: (You can read more here)

Primerica Reviews: Pros & Cons

Pros

- Started in 1977

- Long track of profitable years

- Offers different types of financial products and services

Cons

- Does not sell permanent life insurance and offers no online term quotes.

- Uses a multilevel marketing structure for sales.

- MLM has a very low success rate

- Primerica’s sales representatives earn only an average of $500 per month

Get started with the best training program in online business – this is where I learned to earn up to $1,174.09 a day. Try It FREE.

Is Primerica A Business Scam Or A Pyramid Scheme?

This is one of the biggest questions that people have when they hear about Primerica and it’s business practice.

So, the good news – after all the allegations and legal issues, Primerica is still one of the MLM companies especially when it comes to insurances and investment.

The bad news is – there are still a lot of people who get confused about their business practice as people think that all MLM businesses are scams and pyramid schemes.

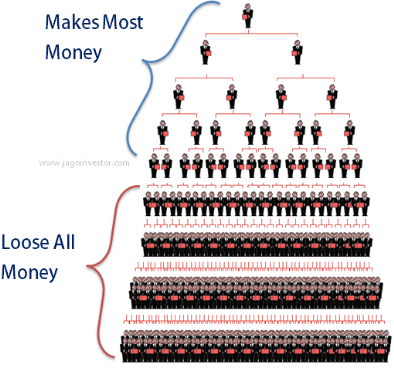

Take a look at this illustration: Unfortunately, this is exactly how Primerica Model Looks like.

Therefore, the people who join Primerica for business purposes or any other MLM business are ending up in focusing on RECRUITMENT because that’s where the money is (which is the main element of a pyramid scheme).

There are, of course, some exceptional people who are lucky enough to be one of the pioneers in any multi-level marketing business. Unfortunately, the new members have to chew on the fact that there are only 1% who earn money and 99% lose money in MLM business.

Get started with the best training program in online business – this is where I learned to earn up to $1,174.09 a day. Try It FREE.

Primerica Reviews: Conclusion

So, what is Primerica.com? It is the website for Primerica, a 11-tiered MLM business selling primarily term life insurance and other financial services in investment and debt-management.

Does Primerica Offer The Best Life Insurance? Nope or better to say – we don’t know as their sales strategy deprive them to disclosed their quotations on their website, Primerica.com.

Is Primerica A Business Scam?

No. Primerica is a legit MLM company. However, MLM companies are commonly mistaken as pyramid schemes and scams. That is why there are only 1.40% of all their sales force (see above) are boosting this business opportunity because of the fear of rejection and to be called as a scammer.

I have tried 3 MLM businesses in many years, so I know that MLM business model are not that as easy as they present it. Because the truth is MLM business is a broken business strategy for ordinary people like you and me.

I honestly hope that I have talked you out of joining Primerica for part-time business purpose.

There is definitely a much better way of earning money from home. Check out below.

Get started with the best training program in online business – this is where I learned to earn up to $1,174.09 a day. Try It FREE.

A Profitable Home Business Is Simple

If you have the right training, supportive community & mentor, making money online is easy. Click below and get all the three: